News – Stay Updated About The Latest in Banking

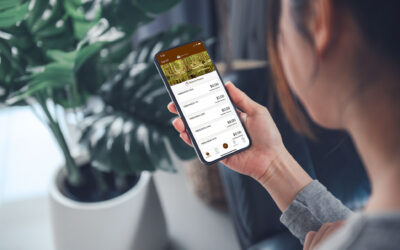

Features And Benefits of Patterson State Bank’s Mobile App

Thanks to mobile banking, managing our finances on the go has become a convenient option. It has brought unparalleled ease and accessibility, allowing us to handle transactions and keep track of our accounts with just a few taps on our smartphones. Patterson State...

Tips for Avoiding Scams and Protecting Your Finances

Did you know that Google blocks approximately 100 million phishing emails daily? Phishing attacks are the most common cyber threat, using various deceitful tactics to trick people into sharing sensitive information. These tactics often include fraudulent emails,...

6 Fantastic Benefits Of Online And Mobile Banking

Did you know that 78% of adults in the US prefer to bank via a mobile app or website? Well, it's not without good reason. In fact, mobile and online banking offers many fantastic benefits that you simply don't get with more traditional forms of banking. Join us as we...

Your Ultimate Guide To FDIC Deposit Insurance

At Patterson State Bank, we know that understanding deposit insurance can be complex, so we want to provide you with more information about FDIC coverage and the safety of your bank account funds. We’ve put together a list of frequently asked questions to help you...

Why You’re Receiving Unwanted Credit Offers After Applying For A Loan

Are you receiving unsolicited credit offers from other lenders after applying for a loan? It's natural to feel concerned about receiving unsolicited credit offers from other lenders. It can also be frustrating and confusing, especially if you're not sure why it's...

8 Practical Tips For Teaching Your Child To Save Money

8 Practical Tips For Teaching Your Child To Save Money As a parent or caregiver, one of your most important responsibilities is teaching your child the skills they need to succeed in life. That includes financial literacy! By teaching your child about money and saving...

6 Tips For First-Time Homebuyers

Are you considering buying your first home? It's an exciting but overwhelming time with so many decisions to make. One of the most important considerations is your financial situation. In this blog, we'll discuss 6 home buying tips for assessing your debt, saving for...

How to create a monthly budget

Using a monthly budget to keep track of your spending can be a helpful tool to show you where your money is going and help keep you on target to reach your financial goals. A budget can also give you a better visual of what you can actually afford, and areas where you...

Identity Theft & Protection Awareness

Identity theft occurs when your personal or financial information is used without your permission to commit fraud. Identity theft can lead to financial loss, damaged credit, and cost you time as you try to restore your credit. The time it takes to fix the issue can be...

Budget Tips for the Holidays

Patterson State Bank wants to make your holiday season merry and stress-free by sharing these great budget tips that will help keep you on track with your spending. Review last year’s spending How much did you spend on holiday shopping last year? Taking an inventory...

Get Smart About Credit – Credit 101

Finances are part of adult life. You'll need them to support your lifestyle and pay bills such as rent, utility, school fees, and other personal needs. If you also run a business, you need money to buy new inventory, pay pending bills and wages, and settle other...

Online Banking for College Students

College students have a lot on their plates—from classes and exams to study breaks and social commitments. Time is valuable and convenience is key. Fortunately, Patterson State Bank offers accounts and services to help make things a little easier. Here are just a few...